Tax Credits 2025

Tax Credits 2025. You can view this form in: Get rewarded for going green.

Find out which deductions, credits and expenses you can claim to reduce the amount of tax you need to pay. The maximum credit you can claim each year is:

Deductions Are Applied Before You Calculate Your Taxes, While Credits Are Applied To Your Final Tax Bill.

If you’ve put money in an ira, 401 (k), 403 (b) or other eligible retirement account, the saver’s credit could get you a tax credit worth between 10% and 50% of your 2023 contribution amount.

If Taxpayers Made Energy Improvements To Their Home, Tax Credits Are Available For A Portion Of Qualifying Expenses.

New tax credits and deductions.

Department Of The Treasury And Internal Revenue Service (Irs).

Images References :

Source: insideevs.com

Source: insideevs.com

2023 Federal Tax Credit Only Six BEV Manufacturers Qualify, Earned income tax credit (max.) 1,875: If you qualify, you can claim these 2023 tax credits on the tax return you file in 2025.

Source: paarmelis.com

Source: paarmelis.com

2021 Child Tax Credits Paar, Melis & Associates, P.C, Find out which deductions, credits and expenses you can claim to reduce the amount of tax you need to pay. Get rewarded for going green.

Source: www.simplepay.co.za

Source: www.simplepay.co.za

National Budget Speech 2023 SimplePay Blog, Tax credits and deductions can be key to reducing what you owe come tax season. For those with moderate and low incomes, the earned income tax credit (eitc) is worth anywhere from $600 for filers without qualifying children to $7,430 with three or more qualifying children.

Source: blinkcharging.com

Source: blinkcharging.com

How Do the Used and Commercial Clean Vehicle Tax Credits Work? Blink, All tax amounts are rounded to the nearest dollar. Tax credits and deductions can be key to reducing what you owe come tax season.

Source: airprosusa.com

Source: airprosusa.com

Energy Tax Credits for 2025, Home » new tax credits and deductions. Deductions are applied before you calculate your taxes, while credits are applied to your final tax bill.

Source: www.floridapowerservices.com

Source: www.floridapowerservices.com

Solar Federal Tax Credit Increased to 30!, People should understand which credits and deductions they can claim and the records they need to show their eligibility. For people with visual impairments, the following alternate formats are also available:

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The tax credits in this table are the amounts to be deducted from the tax payable. Deductions are applied before you calculate your taxes, while credits are applied to your final tax bill.

Source: www.autopromag.com

Source: www.autopromag.com

Here are the cars eligible for the 7,500 EV tax credit in the, For people with visual impairments, the following alternate formats are also available: See general information for details.

Source: www.dochub.com

Source: www.dochub.com

Alberta tax brackets 2023 Fill out & sign online DocHub, New tax credits and deductions. Earned income tax credit (max.) 1,875:

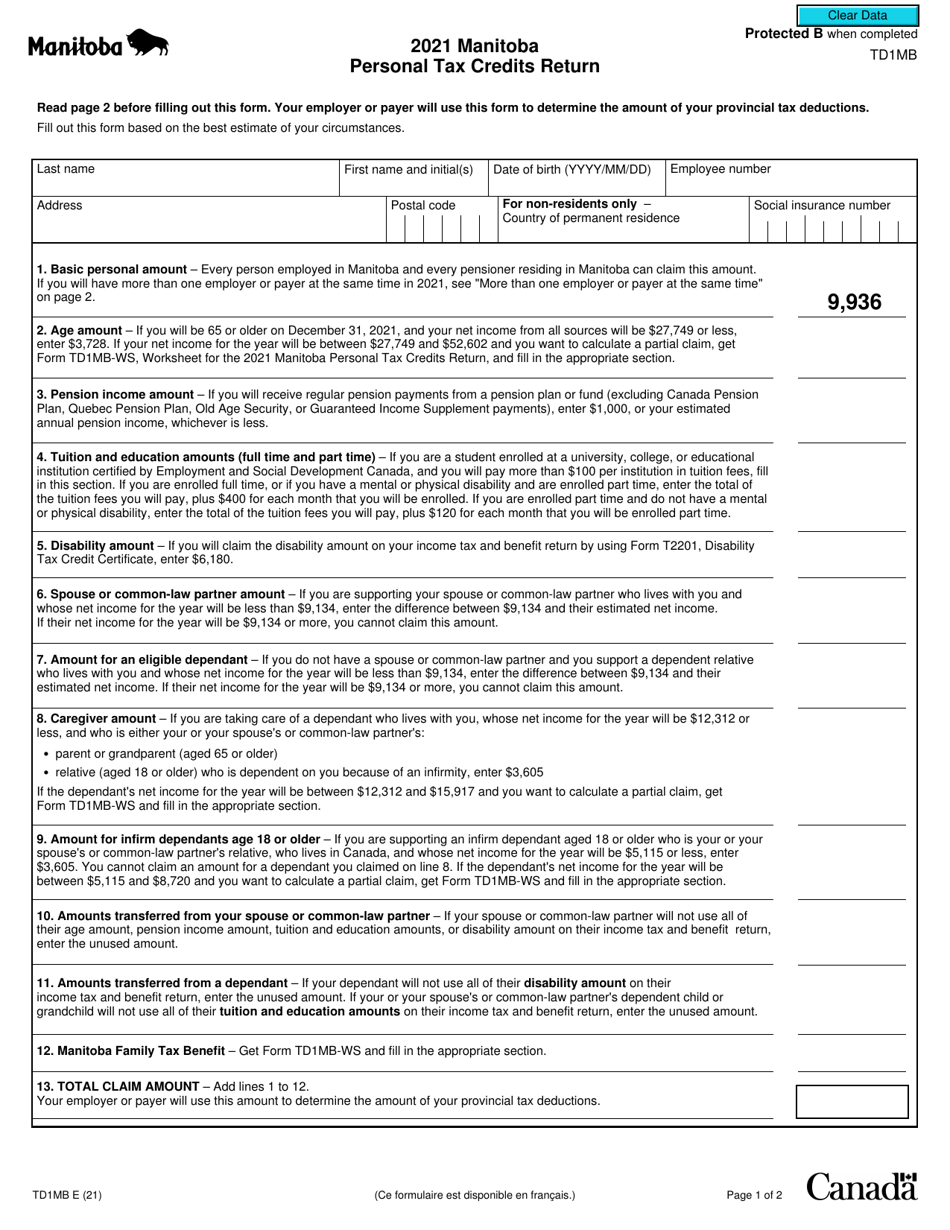

Source: www.templateroller.com

Source: www.templateroller.com

Form TD1MB Download Fillable PDF or Fill Online Manitoba Personal Tax, Some of the most popular tax credits fall into five categories. March 24, 2025 at 6:00 pm pdt.

See General Information For Details.

4, 2025 — tax credits and deductions change the amount of a person’s tax bill or refund.

If You File On Paper, You Should Receive Your Income Tax Package In The Mail By This Date.

You can view this form in: